February 10, 2021 by Carol Britton Meyer

With the town facing a projected $7 million budget deficit for fiscal 2022, the possibility of a Proposition 2-1/2 override resurfaced again during last night's well-attended remote selectmen's meeting.

"No decisions have yet been made," Selectmen Chair Mary Power said. "All options are on the table."

At the same time, Town Administrator Tom Mayo reported the good news that with the school committee, town officials, and the advisory committee working together -- and due to "sound fiscal management" -- the Fiscal 2021 budget is in good shape.

The result is that $1.2 million of the $3.3 million appropriated from the "rainy day" fund by Town Meeting 2020 due to pandemic-related issues and expectations will be returned to the town, along with an anticipated $800,000 to $900,000 from reimbursed COVID-19-related expenses so far -- for a total of about $2 million.

"Returning some of the fund balance authorized by Town Meeting will bode well and will demonstrate to our citizens that we have been prudent with these funds," Power said.

With Town Meeting planned for this Spring, the selectmen, advisory committee, and the school committee are reviewing budget proposals on the town and school side.

Among the options to close the projected gap in the Fiscal 2022 budget are using money from the "rainy day" fund -- which has a $6 million surplus but is normally used for one-time rather than operational/recurring expenses -- an override that becomes part of the permanent tax base on top of the yearly Proposition 2-1/2 increase, cutting costs, other options, or a combination of all or some of the above.

The tax impact of an override would be $116 per $1 million on the average assessed value home ($875,000), or about $809 for a $7 million override.

One way to help struggling senior citizens is the recent implementation of a means-tested abatement program for which town officials would like to set aside $500,000 for Fiscal 2022. There will be further discussion about the program and the funding mechanism.

Priya Howell supports the abatement program "if it goes hand-in-hand with an override."

Power alerted the large number of participants that while the word around town yesterday was that last night's meeting would involve a school budget hearing, that was not the case.

"I welcome everyone who is here, but that is not what we will be discussing tonight -- although the information that will be shared will inform future budget discussions," she said.

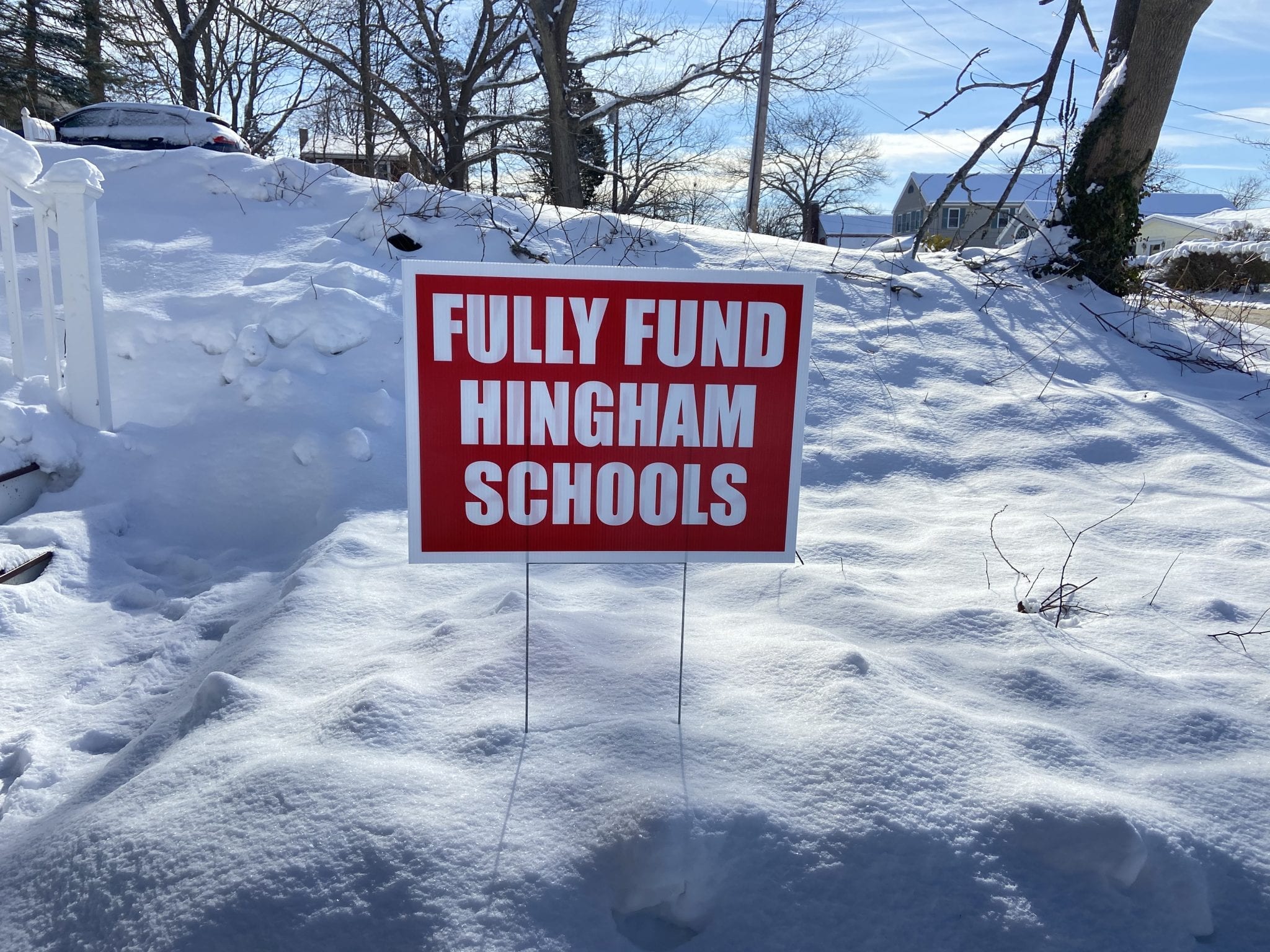

A number of callers had changed their usual Zoom names to "Fund HPS" and "Fully Fund HPS."

In fiscal 2022, as in fiscal 2021, meals tax and motor vehicle excise tax revenues are down, as are investment income due to low interest rates and ambulance receipts. New growth revenue is projected to drop by $1 million due to a significant decrease in commercial activity as compared with an uptick in residential home improvements.

Advisory Committee Chair Robert Curley noted that "we have some substantial debt exclusions on the horizon, including Foster School and potentially a new public safety facility." A debt exclusion raises property taxes for a limited number of years.

Advisory Committee member Evan Sheehan noted that the school budget increase over the past several years has exceeded the usual recommended annual two percent for both the town and school budgets.

"I feel like we're dancing around the topic," he said. "We can't stare down the barrel of a $7 million gap and not have a constructive discussion about how to close that gap. We forecast and budget conservatively, and I think we need to take a look at the sustainability of this budget."

Power said it's important to consider the cumulative effect of potential overrides, debt exclusions, and the annual Proposition 2-1/2 tax increase.

Following the meeting, Power told the Hingham Anchor: "The board appreciates the participation of nearly 150 of our fellow citizens at last night’s meeting and the constructive and respectful tone of the conversation. We look forward to continuing to work with town and school administration, our fellow citizen volunteers, and members of the public to determine the best path forward for our town."

Both the fiscal 2021 financial management plan and the preliminary fiscal 2022 financial revenue forecast will be posted on the town website, hingham-ma.gov, on Tuesday.

In other business at the meeting:

* The selectmen authorized Chair Mary Power to sign the Massachusetts School Building Authority feasibility study agreement for Foster School. The study is the next step in the process of the town seeking partial state reimbursement to repair Foster or to build a new school.

Its purpose is to investigate potential options and solutions, including cost estimates, to Foster's deficiencies and issues as identified in the Statement of Interest submitted for the town or as otherwise determined by the Authority.

* The board proclaimed Saturday, Feb. 13, as Lincoln Day. As background, the Town of Hingham was settled in 1635 by a small band of Puritan pilgrims, many of whom came from Hingham, England and the surrounding area.

Among the descendants of those original settlers were two famous American public figures who shared the common family name “Lincoln” as well as a common heritage -- Benjamin Lincoln, a life-long Hingham citizen and a hero of the American Revolution and Abraham Lincoln, the 16th President of the United States and "the towering figure of the Civil War."

Because the usual live ceremony won't be held this year due to the pandemic, the board is urging the residents of Hingham "to take to heart the examples of the two Lincolns and those of four centuries of Hingham citizens . . . and participate in some concrete way in the strengthening and preservation of this community of Hingham and the broader communities of state and nation for the generations that will succeed us."