January 30, 2023 By Nes Correnti

Timing is a funny thing. This weekend I went to an 80’s themed party. I then came home and wrote about revenue issues the town is facing due to Proposition 2 ½ (Prop 2 ½). Did you know Prop 2 ½ refers to a Massachusetts law enacted in 1980.

Prop 2 ½ strictly limits the amount of property tax revenue a community can raise through real and personal property taxes. This revenue is technically called the Tax Levy. Prop 2 ½ limits how much the levy can be increased from year-to-year.

Under Prop 2 ½, a community’s levy limit increases automatically by two factors:

1. an incremental increase of 2.5% of the prior year’s levy limit, and

2. a dollar amount derived from the value of new construction and other growth in the local tax base since the previous year, called New Growth.

The 2.5% increase and the new growth number are both added to the prior year’s levy limit to reach the current year’s levy limit.

Notably, the 2.5% increase limitation applies only to the Levy Limit, and not to any individual property owner’s tax bill. A common misconception is that Prop 2 ½ restricts the amount your property tax bill can increase to 2.5%. Increases in New Growth will also impact your property tax bill.

A community can exceed its levy limit with voter approval. Prop 2 ½ gives communities flexibility to support local spending for schools and municipal operations. Communities can levy above its levy limit permanently or temporarily by passing by majority vote in an election an override or a debt exclusion override.

By passing an Override a community can assess taxes in excess of the automatic annual 2.5% increase and any increase due to new growth or its Levy Limit. An override results in a permanent increase in the levy limit of a community. These funds can be used for both operating and capital expenses.

So why was I writing about Prop 2 ½ on a Saturday night? I came home to read some comments on Facebook about the recent news on what cuts our schools might be facing if we don’t pass an override at Town Meeting and town election this spring. There were some residents who were well aware of the situation our town is facing, however there were several who were surprised. We, as an entire town, knew we would have a deficit to deal with come Fiscal Year ’24. We voted to add critical positions during the pandemic. We were fortunate to have one-time money from the state and federal government, as well as “rainy-day” funds (local reserves), to pay for the added positions. But we knew the cliff was coming.

However, committees have been communicating our revenue problem here in Hingham for years before that.

The Advisory Committee noted the following:

2018 Annual Town Meeting Warrant:

- “While the financial position of the Town is solid, balancing the budget was challenging once again this year. The growth of expenses continues to outpace the growth of revenues. The five-year forecast reflects flattening revenue, driven by a decrease in new growth and an assumption that State aid will decrease. The Town would benefit from a long-term financial management plan, including an examination of capital priorities and service levels, all the while being mindful of the impact on taxpayers and rating agencies.”

2021 Annual Town Meeting Warrant:

- “Even before arrival of the pandemic, balancing the budget was a challenge. As has been true for some time, revenue growth had not been keeping pace with increases in expenses needed to maintain level services and meet demands for new services.

- Economic fallout from the pandemic further exacerbates this trend.”

In August 2021, in response to increasing budget pressures that were exacerbated by the global COVID-19 pandemic, the Town Administrator established a Sustainable Budget Task Force (SBTF) to develop options to facilitate a sustainable five-year Financial Forecast for the Town for fiscal years 2023 through 2027. I was grateful that I was able to serve on the SBTF.

The SBTF was clear, we have a revenue problem here in Hingham. We were able to pay for increased budgets over the years with Prop 2 ½ PLUS new growth. We have not seen new growth numbers at the same level for a number of years. (As I remind anyone who will listen, with new growth comes the demand for additional services, so while the added revenue is great in the short-term, the needed increase in expenses catches up to us. We need to also be thoughtful about the infrastructure we have in place here in town as we continue to have new growth.)

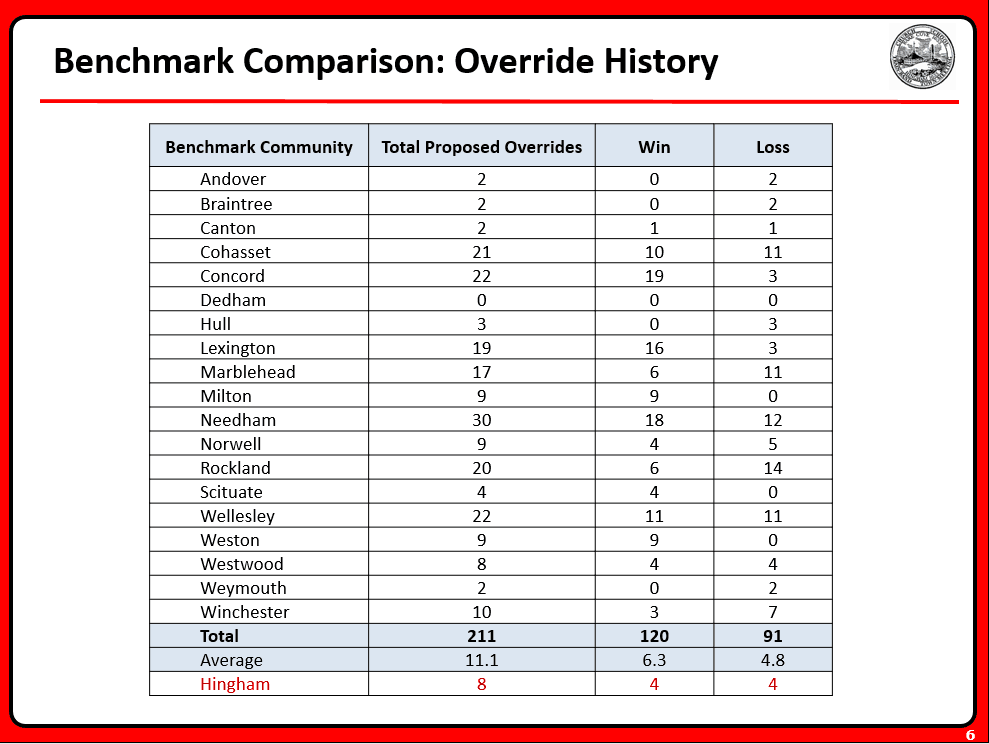

Overrides are not a new concept and many towns do them. Since 1990, our 19 benchmark communities have proposed a total of 211 overrides, which comes to an average of 11.1 proposed overrides per community compared to Hingham’s 8 proposed overrides during that period. Hingham’s benchmark communities have also levied taxes through overrides more often.

Since 1990, our 19 benchmark communities have passed a total of 120 overrides, which comes to an average of 6.3 “wins” per community compared to Hingham’s 4 “wins” during the same period.

Many towns did overrides after the 2008 Great Recession in order to reset their town’s budgets. Hingham did not.

Hingham last did an operational override for Fiscal Year 2010, relating to the opening of East Elementary.

From the SBTF report:

- “Town Meeting and the voters at the 2009 Town election approved an override request of $1.1 million. With the recession continuing in 2010, the FY11 education budget was reduced by $1 million despite increased enrollment. The Advisory Committee recommended to Town Meeting to apply $961,000 of Federal Stimulus funds to close the budget gap. In addition, State education funding was reduced that year at the same time as State education mandates and required special education services were increased, resulting in the Town using a larger percentage of local funds for Hingham students

- During the past 10 years, Hingham Public Schools and the Town have partially addressed these education budget deficits and enrollment increases by using available funds, rather than asking taxpayers for an additional override. HPS has gradually replenished staff, implemented state mandates, updated curriculum standards, maintained properties and buildings, negotiated employee contracts, and managed enrollments. This gradual replenishment resulted in annual school budgets growing at a rate of 4-8% per year through FY21.”

The schools is not the only department that has requested additional services. Police, fire, senior services, DPW, library, etc. all have additional needs. I believe Prop 2 ½ is a tool for communities to have open dialogue as to what we services want to pay for. I believe we can have this dialogue and determine how best to work together to fund the needs of our town.

I encourage all Hingham residents to re-read our report that was issued on January 31, 2022. The recording of the February 1, 2022 Select Board meeting is a good alternative for those who want cliff notes. I’ve included a link to both.

Let’s keep the conversation going. #Hinghamtogether

Sustainable Budget Task Force final report:

Sustainable Budget Task Force final report

Sustainable Budget Task Force presentation at the February 1, 2022 Select Board meeting:

Sustainable Budget Task Force presentation at the February 1, 2022 Select Board meeting