February 1, 2023 By Carol Britton Meyer

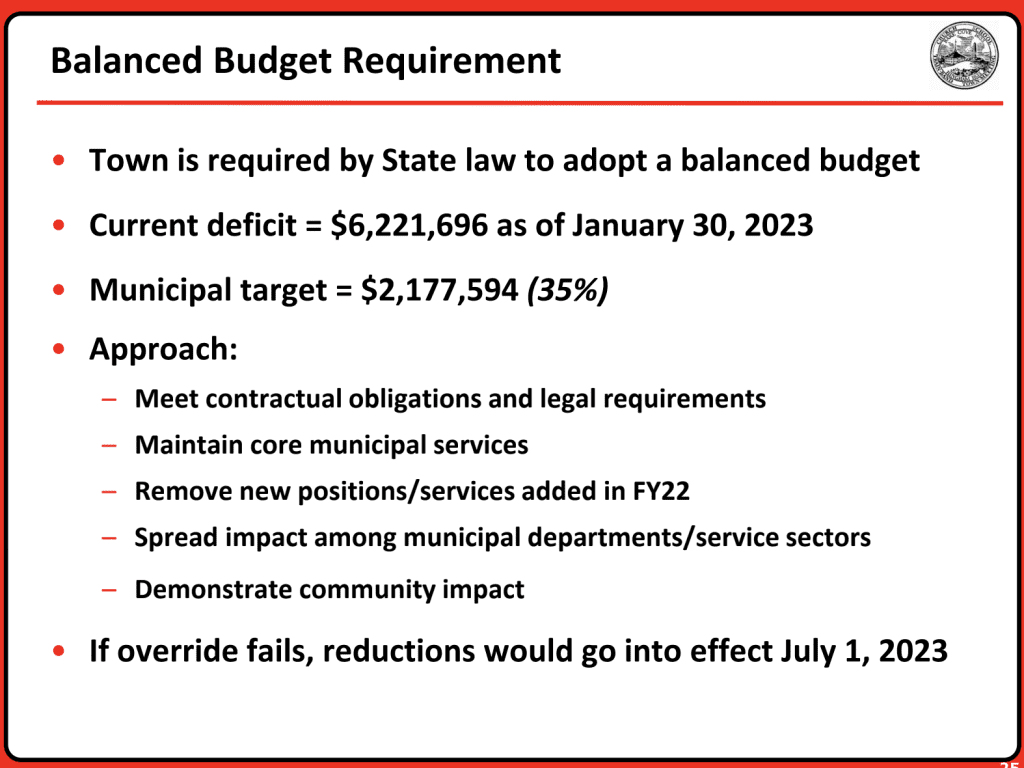

The Town of Hingham is entering the Fiscal 2024 budget season with a $6.2 million deficit.

This means that in order to achieve a balanced budget — which is required under state law — significant cuts in staff and services would be required without the passage of an operating override to make up the shortfall, Town Administrator Tom Mayo told the Select Board Tuesday night.

School Department administrators recently presented a balanced school budget to the School Committee, including the potential elimination of 60.6 Full Time Equivalent positions across the school district as well cuts to student services, arts, athletics, and other academic programming — to close an estimated $4.8 million budget gap on the school side unless an override is passed.

Balancing the budget on the town side would require a total of about $2.3 million in cuts, according to Mayo. These include at least 22 Full Time Equivalent positions in general government, public safety, public works, human services, and culture & recreation.

These potential staff cuts would result in dozens of impacts that would affect citizens, from decreasing maintenance of municipal facilities, reducing Animal Control response capabilities, diminishing the ability to support community members with mental health crises, and increasing Fire Department response times beyond normal standards to delaying the filling of potholes, closing the Swap Shop at the transfer station and the yard waste area 1 to 2 days per week, reductions in the Senior Center transportation program, closing Hingham Public Library on Sundays year-round and reducing children’s and other programming offered there, among others. (See the town website for full details.)

This means that maintaining a level services budget for the schools and municipal departments would require an override.

An override is a voter-approved, permanent tax increase designed to provide a community with the ability to generate sufficient revenues to fund costs that are likely to continue into the future, such as annual operating and fixed expenses.

A majority vote at Town Meeting on April 24 and a majority vote on a ballot question at the Town Election on April 29 in favor of an override would be required for one to pass.

The reason for the deficit is that “critical capacity” was added to school and municipal services during the pandemic, funded primarily by one-time federal money and use of a portion if the town’s reserve fund.

These positions/services included 32 Full Time Equivalent Hingham Public Schools positions; a townwide field maintenance program; a second assistant town administrator; a senior planner; a mental health/crisis response clinician; a transfer station heavy equipment operator; and a communications consultant.

“As we move away from the pandemic and seek to bridge the funding gap permanently, the town must either reduce services to balance the FY24 budget or raise recurring revenue through an override to maintain current operations,” Assistant Town Administrator for Finances Michelle Monsegur said during a preliminary budget and override discussion.

It was noted that the Advisory Committee commented in the 2022 Annual Town Meeting warrant as follows: “Budget development for FY23 saw concerns related both to ongoing effects of the pandemic (student learning loss) and to structural deficits in the municipal and the school budgets. The additional positions and services added to the FY22 budget remain critical to maintaining a level of services to continue addressing learning loss and necessary town services.”

Voters at that Town Meeting “unanimously chose to maintain the added positions and services, employing $3.8 million in available federal and local one-time monies to balance the FY23 budget, and begin planning for an override in FY24,” Monsegur explained.

The Advisory Committee also explained in the 2022 Annual Town Meeting warrant that “the use of one-time revenue is not sustainable, and the town needs to reconcile revenues with expenses through an override. While the Sustainable Budget Task Force (SBTF) identified several potential revenue options, they are insufficient to meet the near-term budgetary needs, and it is expected that an override will be placed before the citizens at the 2023 Annual Town Meeting and 2023 Annual Election.”

That said, if the potential override were to not pass, “then the town will have to reduce expenditures to match revenues. This action would include reducing staff and services,” the Advisory Committee cautioned at that time.

Among the SBTF’s recommendations is for both the municipal and school departments to target a 3.5 percent expenditure growth rate in future years to better align expenses with available revenue and that “the town should consider proposing a potential override in FY24 to maintain or grow services.”

Later in the discussion Tuesday night, Select Board member Joseph Fisher said that targeting a 3.5 percent expenditure growth rate — which is a percentage point higher than the limit on how much property taxes can be raised under Proposition 2-1/2 — “is like committing to regular overrides if we need [3.5] to succeed as a town. There’s no getting around it, and there needs to be a public discussion at Town Meeting so people understand what that kind of commitment involves.”

Mayo agreed that’s a conversation that will take place. At the 3.5 percent rate, he said, “we could likely get through 4ish years before another override is proposed, but there WILL be a need for another one unless we get some significant development in town [to pay a substantial amount of property taxes].”

The goal, Mayo said, is to determine “how to get the maximum number of years between overrides” through a financial management plan. “New growth projects are drying up, and the cost of municipal government is increasing. We’ll need regular overrides [to maintain staffing and services]. How regular they should be we will have to decide.”

Monsegur acknowledged that this level of tax increases may be difficult for some residents to absorb and outlined a number of property tax relief programs available to qualifying residents.

Select Board Chair William Ramsey and fellow board members Fisher and Liz Klein agree that adding the new positions and services using one-time federal funds and money from the town’s reserve fund was the right decision both times.

“The proposed potential cuts to the school and municipal departments are massive and would set the schools back by years,” Ramsey said. “Town services would also be drastically decreased.”

He noted that the potential for an override has been discussed for some time. “The School Department and Committee, Advisory Committee, and Select Board will work together to decide whether to put an override [on the 2023 Town Meeting agenda and Town Election ballot] and what the amount or amounts would be,” Ramsey said. “The decision won’t be made in a vacuum.

People are down about a lot of things these days, but we have faced challenges in the past and will get through this together.”

Klein talked about the importance of gathering input from the community — “to hear from all sides.”

Fisher said he wants to ensure the town “is being prudent with everyone’s finances. This discussion really puts an emphasis on the importance of revenue growth,” he said.

Resident Glenn Mangurian said that in his opinion, the public needs to understand that “you can’t run a town like Hingham without having an override. The question is, what is the appropriate frequency? We’ve gone 14 years since the last one, so I think [the possibility of needing one] every four or five years is an important point to make.”

He went on to suggest that taxpayers might want to consider whether the additional impact on their tax bills from an override would be worth paying to save jobs and maintain the level of services to which Hingham residents have become accustomed.

School Committee Chair Michelle Ayer said it’s important to ensure that all residents get the services they need “without undue burden.” She assured the Select Board that school officials and committee members could be counted on to be “good partners and stewards” while ensuring that students’ needs are met and advocated for.”

The Select Board will endeavor “to come up with some creative ideas to generate more revenue besides property taxes,” Ramsey said. “We will be talking about this topic for the next couple of weeks. I encourage feedback and input from citizens and ask them to stay engaged and active, helping those involved make the best decision for the town” regarding a potential override.

The budget presentation is available on the town website. Updates will continue to be posted to https://www.hingham-ma.gov/1025/Town-of-Hingham-FY24-Override, offering information not only about the override but also an override calculator to help residents view the estimated tax increase on their property and property tax relief opportunities. Citizens may also email override@hingham-ma.gov with questions, comments, or concerns.