August 2, 2023 By Carol Britton Meyer

The number of Hingham property owners who are taking advantage of the town’s property tax relief-focused Senior Means Tested Exemption Program is on the rise.

“It’s now in its third year,” Assistant Town Administrator for Finance Michelle Monsegur said during a Select Board update this week, with Director of Assessing Erin Walsh explaining some of the details.

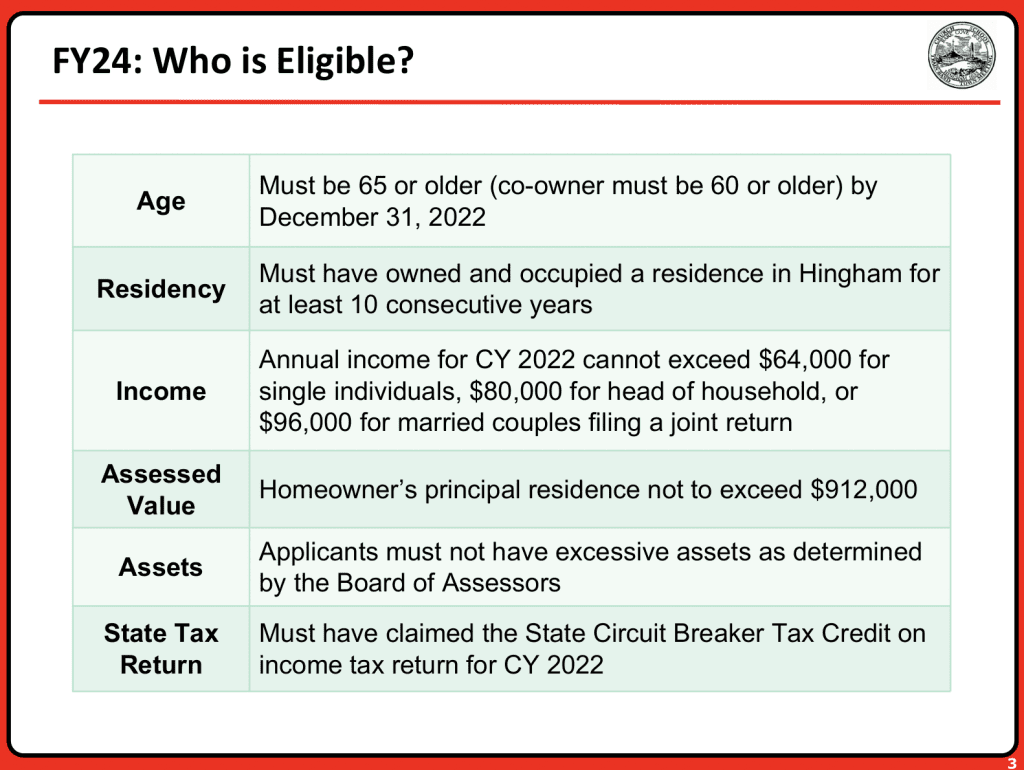

Longtime Hingham residents and property owners who are 65 and older and who qualified for the Massachusetts State Income Tax Refundable Credit known as the Circuit Breaker in Calendar Year 2022 — and who meet certain income and asset requirements — may qualify for the program.

Voters at this year’s town meeting made this exemption, with a maximum Fiscal Year 2024 benefit of $1,200 as set by the state — permanent.

Board of Assessors Chair Joshua Ross explained how much participation has increased in the past year.

There was a 300 percent increase in applications from FY22 to FY23 — from 24 to 96 — and a 330 percent increase in applications approved — from 20 to 86 — with a 298 percent increase in total exemptions awarded — from $22,201 to $88,304.

This is due in large part to the town’s outreach efforts, including flyers mailed with the FY24 preliminary tax bills in late June, flyers and posters placed in town offices, the library, and the Center for Active Living (Senior Center) from June to August, town website postings and an email blast, Facebook posts, and other means of communication.

Applications are due to the Assessor’s Office by Sept. 1, 2023. If eligible, the credit will be applied to Dec. 2023 property tax bills.

To date, 40 applications (including 10 new) have been submitted out of potentially 350 eligible residents. “This time last year, we only had 20 applications,” Ross said. “We’re trying to reach those 350 people.”

There was a big campaign last year [to get the word out], “and we’re hoping to build on that this year,” he explained, suggesting that friends and family members of residents who might be eligible could perhaps help get the word out. “We also hope those who have gotten approval to participate will talk about the program to others [who may also be eligible].”

For further information, call the Assessor’s Office at (781) 741-1455, email Assessors@hingham-ma.gov; stop by the Assessor’s office on the first floor of Town Hall, or visit https://hingham-ma.gov/178/Assessing.

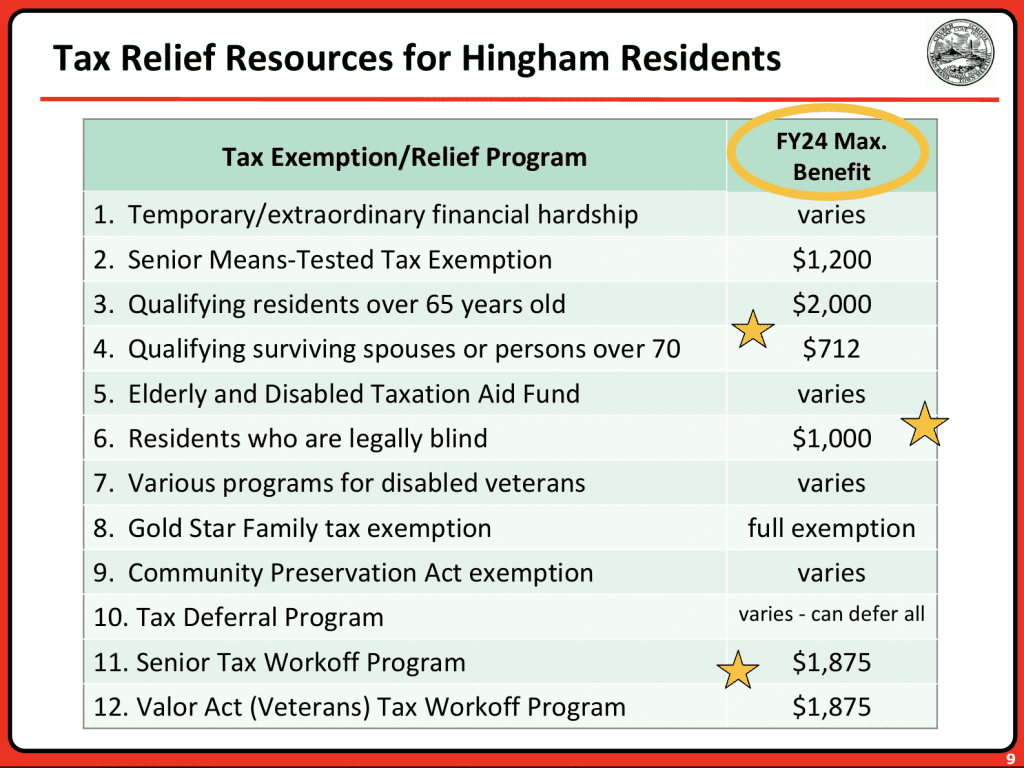

“The staff there can walk citizens through the different [tax relief] programs that are available,” Monsegur said.