November 29, 2023 By Carol Britton Meyer

In keeping with tradition, the Select Board — upon the recommendation of the Board of Assessors — supported maintaining a single tax rate in Hingham for Fiscal 2024 during a joint tax classification hearing Tuesday night.

The purpose of this annual hearing is to decide whether to shift the tax burden between the property classes in town, which determines the share to be borne by each class.

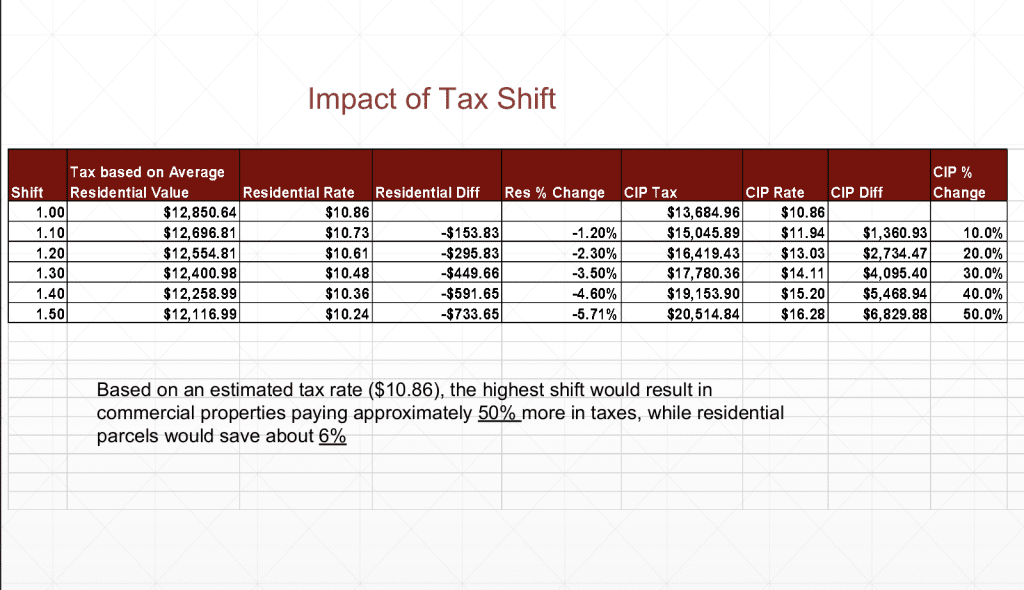

According to a presentation by Director of Assessing Erin Walsh, a split tax rate would shift some of the tax burden from all residential properties onto all commercial, industrial, and personal properties but does not determine how much money can be raised and does not increase revenue for the town.

The Board of Assessors is comprised of Joshua Ross, Randall Winters, and Chrissy Roberts.

Residential properties comprise 90 percent of the tax base, while commercial, industrial, and personal properties comprise about 10 percent. Personal property includes tangible property that is not real property, such as second homes or business equipment.

Based on an estimated tax rate of $10.86 per thousand of assessed value, the highest shift would result in commercial properties paying about 50 percent more in taxes, while residential parcels would save about 6 percent.

It was noted in the presentation that a split tax rate “may be considered anti-business and may discourage businesses from locating in a community.”

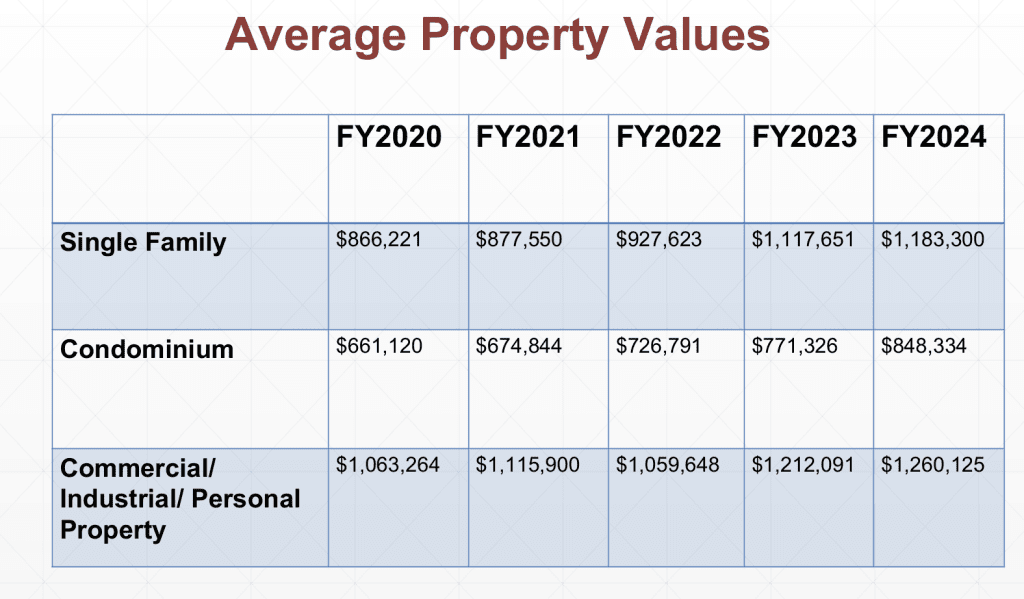

Hingham’s residential properties are valued at $9.05 billion while its commercial properties are valued at $681.76 million, industrial, $216.05 million, and personal property, $135.49 million.

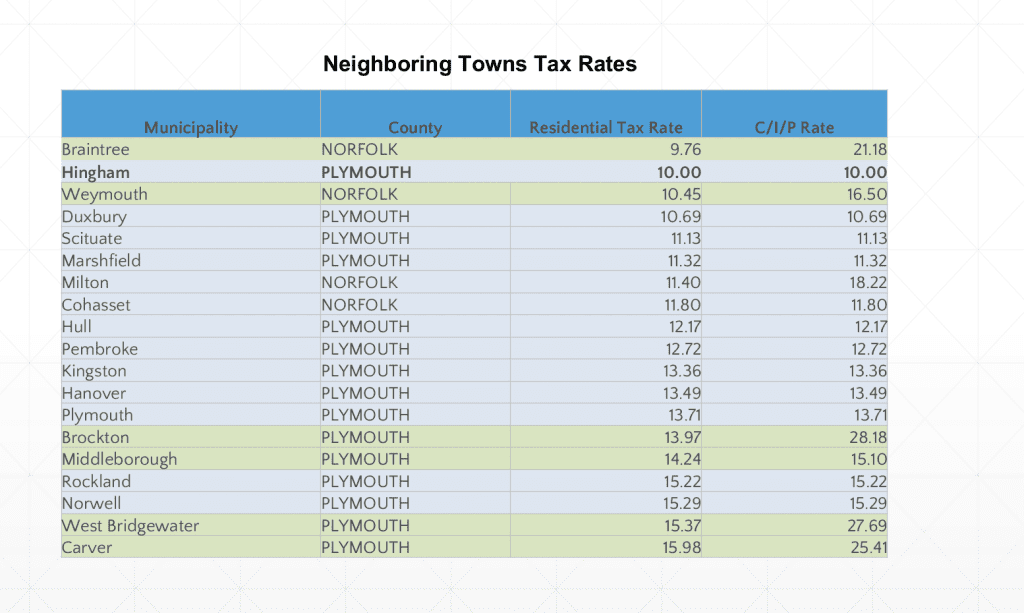

In supporting maintaining a single tax rate, Select Board member William Ramsey said he feels the board has an obligation to protect Hingham’s small businesses, especially those located in the downtown area. He noted that other communities who have a split tax rate have a much larger commercial tax base than Hingham does.

See related charts for average single family, condominium, and commercial/industrial/personal property values, neighboring towns’ tax rates, and the impact of a potential tax shift.