September 15, 2022 By Carol Britton Meyer

Voters at the Nov. 1 Special Town Meeting and at next year's Annual Town Meeting will have some important decisions to make related to a potential $139.6 million debt exclusion to pay for a proposed new Foster School and public safety facility and an anticipated Fiscal 2024 $4.9 million operating override, respectively.

Town Administrator Tom Mayo explained at last night's Select Board meeting that the town has been "underinvesting in its buildings and infrastructure and underfunding some operations, including annual capital items" and that the time has come to begin trying to catch up.

Of the $139.6 million figure, $91.3 million is for the Foster School project (beyond the anticipated roughly $25 million Massachusetts School Building Authority partial reimbursement) and $48.3 million for a new public safety facility off Rte. 3A.

The decision of whether to fully fund the proposed new Foster School -- with partial state reimbursement -- and a new public safety facility for the Hingham fire and police department through a debt exclusion rests with voters at this Fall's STM and the outcome of a Nov. 8 ballot vote.

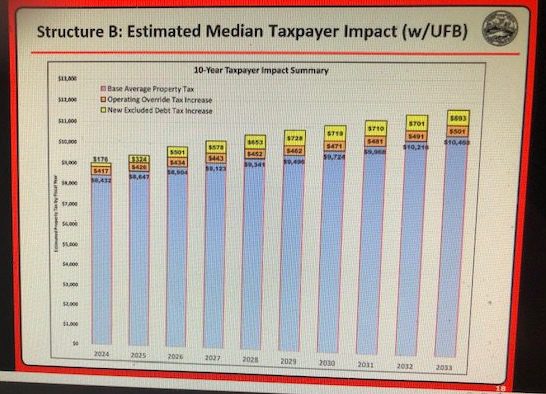

Key to the lengthy discussion about financial considerations and estimated tax impacts was the estimated 10-year taxpayer impact summary of the base average property tax, operating override tax increase, and a new excluded debt tax increase that was presented, depending on whether either or both projects are approved (see chart).

A tax impact calculator will be available at a later date which will provide taxpayers with what the impact of the above three factors will mean to them in terms of their tax bills.

Select Board member Joseph Fisher said he would like to see the costs associated with a potential expansion/renovation of the Senior Center included in the chart when those figures become available so that the lack of those figures "is not perceived as an absence of our commitment" to a future Senior Center project.

The idea is that if the public safety facility gains Town Meeting approval, the Senior Center could expand into that space once vacated.

"We realize that [approval of the Foster and public safety facility projects] would represent a significant tax increase, with many approaches to help mitigate the impacts," Mayo said.

These include potential property tax exemption and relief opportunities related to financial hardship; a new senior means-tested tax exemption; a tax credit for residents over age 65; programs for disabled veterans; a tax deferral program, and a senior tax workoff program, among others, for residents who qualify.

"These programs can help offset some or all of the potential tax increases [depending on an individual's situation]," Asst. Town Administrator for Finance Michelle Monsegur said.

STM voters will also consider whether to support the use of unassigned ("rainy day") fund balance to lessen the tax impacts from large capital projects. Other possibilities include creating additional stabilization funds to mitigate future tax increases and developing a commitment framework among the Select Board, School Committee, and Advisory Committee to control expenditure growth to help mitigate the need for frequent future overrides.

As background, a debt exclusion is a temporary funding measure that excludes certain debt from counting against the Proposition 2-1/2 limit on year-to-year property tax levy increases. In this case, the town is considering spreading out the cost of both projects, if approved at STM, over 30 years to lessen the yearly tax burden.

Due to the projected $4.9 million Fiscal 2024 budget deficit, voters at next Spring's Annual Town Meeting will be asked to decide whether to support an operating budget override, which is a permanent tax increase.

Next steps include finalizing the permitting for the Foster School and public safety facility projects; continued efforts in project value engineering (trying to find ways to reduce costs); Select Board and AdCom warrant article votes; creating the tax impact calculator; an October "media blitz" to educate residents about the two proposed projects and related information; the Nov. 1 Special Town Meeting; and the Nov. 8 ballot vote.