March 10, 2023 By Carol Britton Meyer

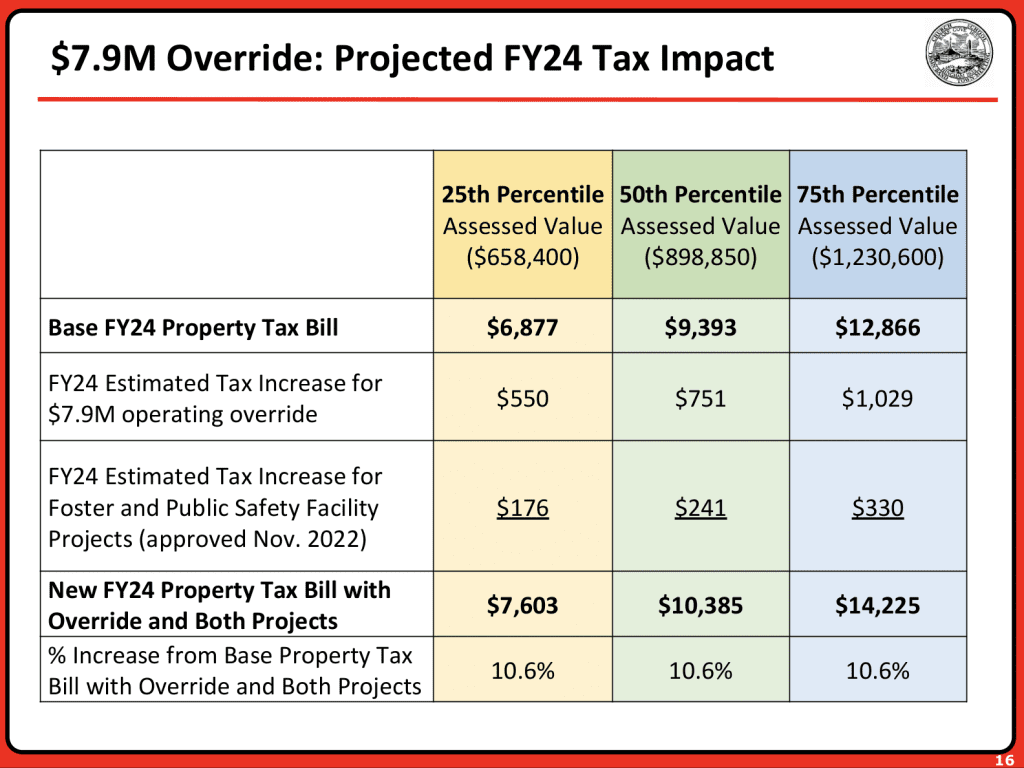

Following a lengthy discussion, the Select Board supported the proposed $7.9 million Fiscal 2024 override to cover a deficit in both the municipal and school budgets and also presented preliminary numbers on how — if passed at the April 24 Town Meeting and the April 29 Town Election through a ballot question — property owners would be impacted by the related tax increase. A majority vote is required for the override to pass at Town Meeting and also at the polls.

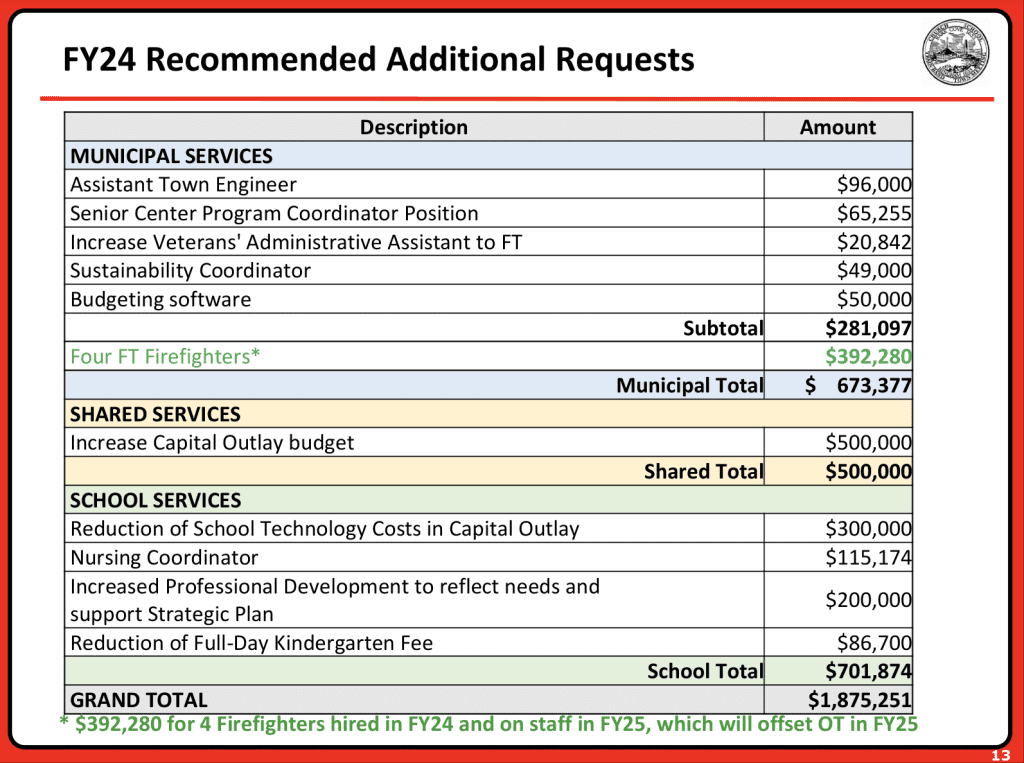

The total proposed combined municipal and school level services budget, which includes $1,875,251 in additional requests, amounts to $147.1 million. The school budget comprises $65.7 million of that amount. (See related chart.)

Without an override, a significant cut in the number of positions and services on both the municipal and school sides would result, with reductions going into effect July 1, 2023, according to town and school officials.

The charts that were presented also reflect the projected property tax impacts from the recently approved new Foster School and new public safety facility, but not the new South Shore Country Club pool. All three projects were approved earlier by Town Meeting. (See related chart.)

“The town is entering the FY2024 budget season with a significant deficit that results from adding critical capacity to school and municipal services during COVID-19 using one-time federal and local reserve funds in FY22 and FY23 to offset these deficits,” Town Administrator Tom Mayo explained. “As we move away from the pandemic and seek to bridge the funding gap permanently, the town must either reduce services to balance the FY23 budget or raise recurring revenue through an override to maintain current operations.”

Mayo recalled Advisory Committee Chair Robert Curley stating at the 2021 Annual Town Meeting that the town was facing the prospect of an override to address “what is essentially a structural deficit in the budget.”

Resident Diane DeNapoli used the expression, “We are all in the same boat” to drive home her concerns about the proposed override. “It is tempting to look at information like the average home price in Hingham being close to a million dollars and assume everyone is doing all right or is wealthy,” but that’s not the case, she explained. “Wellspring [Multi-Service Center in Hull] is working with 50 families in Hingham to find ways to help these residents pay for bills such as housing, utilities, and transportation.”

In addition, the Hingham food pantry is now serving more than 250 people in Hingham. “Many of their clients are our neighbors, senior citizens, and veterans who without the good work of the Hingham Food Pantry would go hungry,” DeNapoli explained.

“When the town suggests people can offset their tax bills with [property tax exemptions and programs], please keep in mind that these are offered only to homeowners,” she said. “They do nothing to help someone renting in Hingham who’s rent will go up based on higher tax rates to the landlord.”

Additionally, she noted that many people make “just a bit too much money after working a long week to qualify for any local or state assistance, but they are struggling to pay their bills. How do these residents stay in the boat?”

When Hingham residents are having hard times financially, “we cut back on spending,” DeNapoli said. “Maybe people work overtime or find a side hustle.”

When a company experiences multiple quarters in the red, “they are forced to do all they can to tighten their margins. This is usually achieved by reducing expenses, trimming personnel costs, bringing in a new management team, and figuring out what, if any rate increases are palpable and competitive in their marketplace,” DeNapoli noted. “So how is our boat looking now? Have we taxed many moderate-income families out of Hingham? Between advancing three capital projects (SSCC pool, $8 million; a new Foster School, $114 million; and a new public safety building for $43 million a nearly $8 million override, which is a permanent tax increase, is being proposed.”

DeNapoli went on to ask town officials and her fellow Hingham residents “to try for one minute to understand that a budget is much more than just numbers — it is a value statement. A healthy, sustainable, and truly equitable town budget would attempt to equally support and respect all of its residents.”

Former Advisory Committee and Select Board member Mary Power asked whether town officials “feel okay about the interest rate presumptions” for the above-named capital projects.

In response, Assistant Town Administrator for Finance Michelle Monsegur said the current interest rates are in the 3 to 5 percent range.

Power also urged town officials to provide information about what the tax impacts will be in FY25 and FY26 and not just for FY24, when the impact will be lower.

DeNapoli and Power were the only two citizens who spoke at the Select Board meeting when public comments were accepted.

Assistant Town Administrator of Operations Art Robert outlined the town’s outreach efforts related to the proposed budget and override, including two public information sessions — March 30, 7-9 p.m. at Town Hall and April 11, 7-9 pm via Zoom.

Information sessions will also be held at Linden Ponds in late March. There will also be videos explaining the budget and override and Select Board office hours, to be announced, among other outreach efforts.

Monsegur explained the various tax relief exemptions and programs for residents who qualify and Town Meeting warrant articles that voters will consider related to expanding some of these programs.

Mayo explained that to help generate more revenue, the town is focusing in part “on pursuing more economic development in South Hingham.”

Residents interested in these programs may call (781) 741-1455, email Assessors@hingham-ma.gov, visit https://www.hingham-ma.gov/178/Assessing or stop by the Assessors Office on the first floor of Town Hall for further details.

FY24 override updates will continue to be posted at https://www.hingham-ma.gov/1025/Town-of-Hingham-FY24-Override. Citizens may also email override@hingham-ma.gov with questions and comments.

The Advisory Committee also met last night to discuss the FY24 school budget and also a proposed Memorandum of Understanding among the Select Board, Advisory Committee, and School Committee outlining a commitment to Hingham citizens that every effort will be made to not ask for another override until at least Fiscal 2028. (See related story.)

“I’m hopeful that with that commitment in place, residents will have confidence that we have put together a plan that makes sense,” Select Board member Joseph Fisher said.