April 4, 2023 By Carol Britton Meyer

Passage of the proposed $7.9 operating override is contingent on an affirmative majority vote at both the April 24 Town Meeting and at the Town Election April 29 through a ballot question.

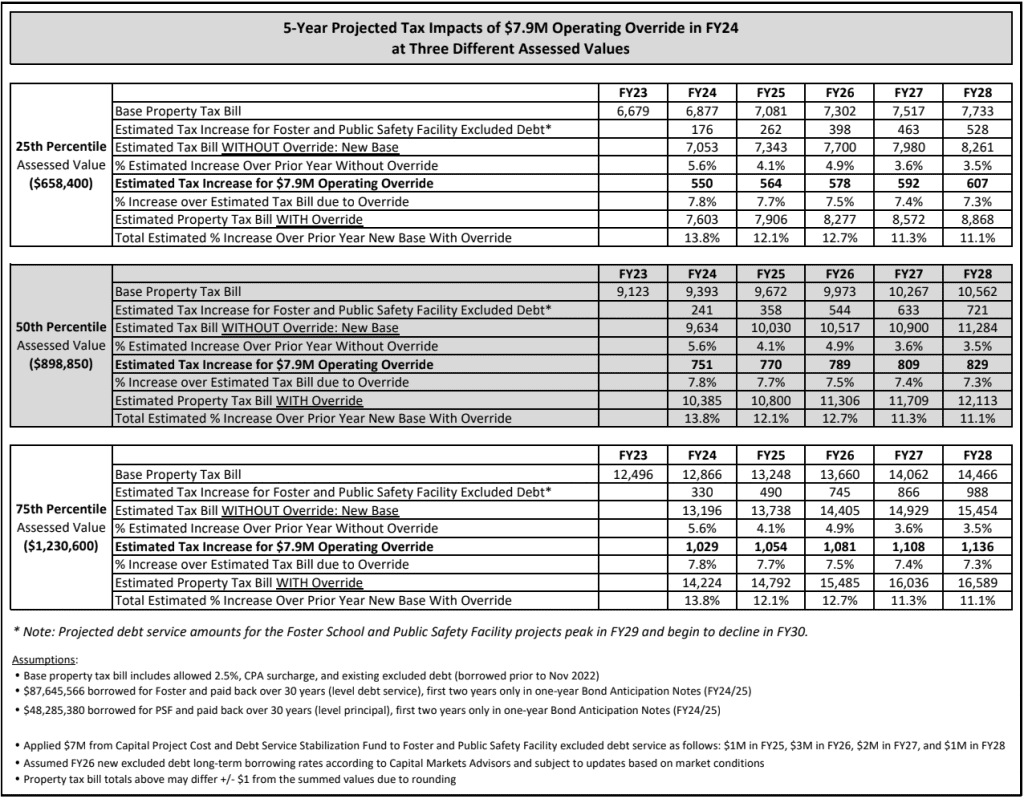

The Advisory Committee report starting on page 5 of the Town Meeting warrant spells out all the details, including the impact of the Fiscal 2022 and 2023 budgets on the Fiscal 2024 budget process and the overall tax impacts that would result over the next five years at three different assessed home values if the override passes. (See related chart posted here for full details.)

The chart — which includes tax impacts from the new Foster School and new public safety facility, the 2.5 percent increase allowed under Proposition 2-1/2, the Community Preservation Act surcharge, existing excluded debt, and the proposed override — shows the following estimated overall property tax increases, subject to interest rates on the new Foster School and new public safety facility borrowings, if the override passes:

- The overall property taxes for a home with an assessed value of $658,400 would increase from $6,679 in FY23 to $8,868 in Fiscal 2028 — representing an estimated property tax increase of 13.8 percent in Fiscal Year 2024; 12.1 percent, FY25; 12.7 percent in FY26; 11.3 percent, FY27, and 11.1 percent, FY28. The estimated tax increases from the override from FY23-2028 respectively would be: $550, $564, $578, $592, and $607

- The overall property taxes for a home with an assessed value of $898,850 would increase from $9,123 in FY23 to $12,113 in Fiscal 2028 — representing an estimated property tax increase of 13.8 percent in Fiscal Year 2024; 12.1 percent, FY25; 12.7 percent in FY26; 11.3 percent, FY27; and 11.1 percent, FY28.

The estimated tax increases from the override from FY23-2028 respectively would be: $751, $770, $789, $809, and $829. - The overall property taxes for a home with an assessed value of $1.23 million would increase from $12,496 in FY23 to $16,589 in Fiscal 2028 — representing an estimated property tax increase of 13.8 percent in Fiscal Year 2024; 12.1 percent, FY25; 12.7 percent in FY26; 11.3 percent, FY27, and 11.1 percent, FY28.

The estimated tax increases from the override from FY23-2028 respectively would be: $1029, $1,054, $1,081, $1,108, and $1,136.

Proposed override budget includes additional requests

The proposed Fiscal 2024 level services $151.36 million municipal/school budget that is contingent on passage of the permanent $7.9 million operating override to cover a deficit in both budgets includes $1.876 million in additional requests that are explained in the Advisory Committee’s report.

The proposed budget includes 30-plus school positions and other positions on the town side that were created using one-time money that is no longer available.

The school budget comprises $65.7 million of the overall budget amount, not including the additional requests that were not included in the initial proposed level services budget — totaling $701,874. The town side of the budget also includes additional requests.

The Advisory Committee report also details the Memorandum of Understanding between the School Committee, Advisory Committee, and Select Board which is “essentially an agreement between taxpayers and town leaders that promises that, in return for an affirmative vote on the override, town leaders pledge to limit the future growth of operating budgets and not request another override for a defined period of time.”

In recent discussions, the understanding has been that no further operational overrides would be sought until at least Fiscal 2028 if the proposed FY2024 override passes.

Under the MOU, a Tax Mitigation Stabilization Fund would be established, subject to Town Meeting approval, to help defray the need for a future override.

The warrant, which is posted on the town website, will be mailed to every Hingham household.

For further details about the proposed override, go to https://hingham-ma.gov/1025/Town-of-Hingham-FY24-Override

To register to vote at the April 24 Town Meeting and at the April 29 Town Election and for information about the Vote by Mail option for the local election, go to https://www.hingham-ma.gov/civicalerts.aspx?AID=1547

Friday, April 14, is the deadline to register to vote at Town Meeting and the Town Election.