September 22, 2022 By Carol Britton Meyer

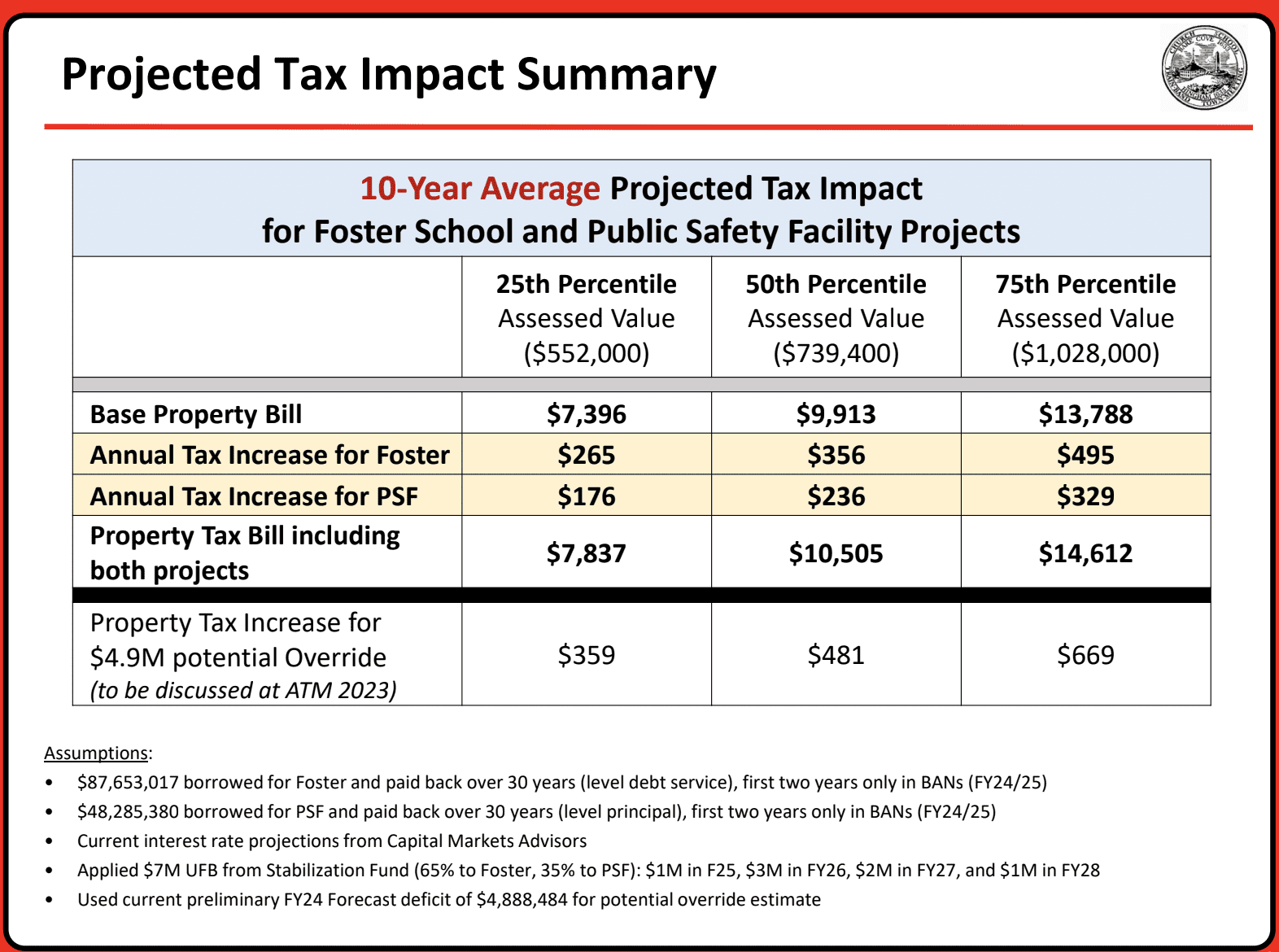

Following the recent Select Board discussion about the important decisions voters will be asked to make at the Nov. 1 Special Town Meeting and at the ballot box on Nov. 8 related to a potential debt exclusion to pay for the proposed new Foster School and public safety facility -- totaling $139.6 million -- the Select Board presented a 10-year average projected tax impact summary at their meeting this week. A debt exclusion is a temporary funding measure.

This would be on top of a potential Fiscal 2024 $4.9 million operating override.

Voters at the STM will be asked to fund the remainder of the full project cost of $113.3 million for a new Foster School, which includes the Massachusetts School Building Authority-approved $24.6 million and the previously authorized $1.1 million for a feasibility study and $3.1 million for design development and pre-construction documents.

As examples, according to the 10-year average projected tax impact for both proposed facilities, property owners with homes assessed at $552,000 would pay an average annual tax increase of $265 for Foster and $176 for the public safety facility; owners of properties assessed at $739,400 would pay an average additional $356 and $236 respectively; and the owner of a home with an assessed value of $1.03 million would pay an average additional $495 for the Foster project and an additional $329 for the public safety facility. (See related chart.)

A tax impact calculator will be available at a later date, which will provide taxpayers with information about how passage of these two warrant articles would specifically affect their tax bills.

Has impact of US Govt action on interest rates taken into account ?

Why do we need a new public safety facility?