October 3, 2022 by Carol Britton Meyer

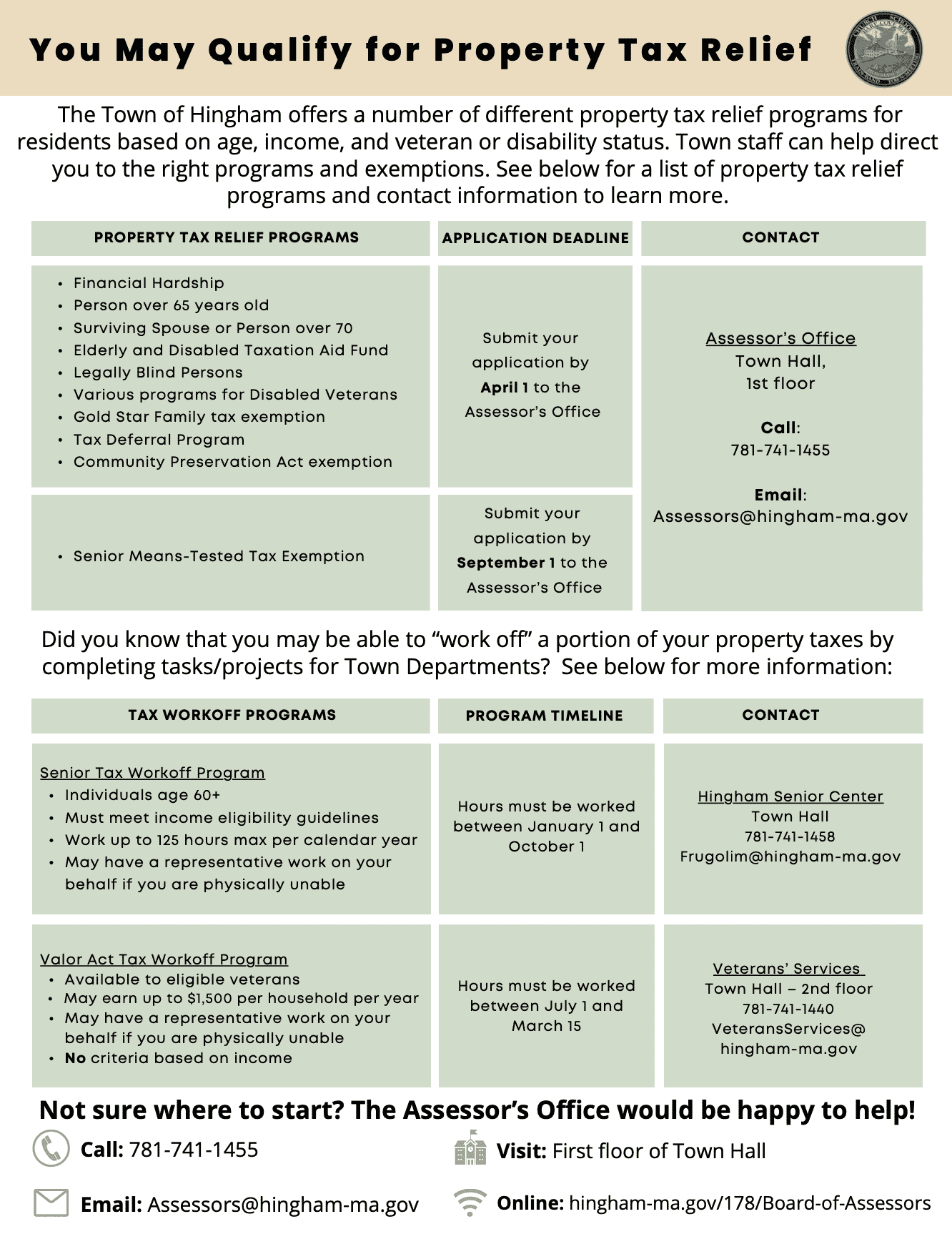

With a possible debt exclusion and operating override on the horizon, the Town of Hingham continues to offer tax relief opportunities for qualifying citizens -- including tax exemption and deferral programs as well as tax work-off programs for seniors and veterans -- based on age, income, and veteran or disability status.

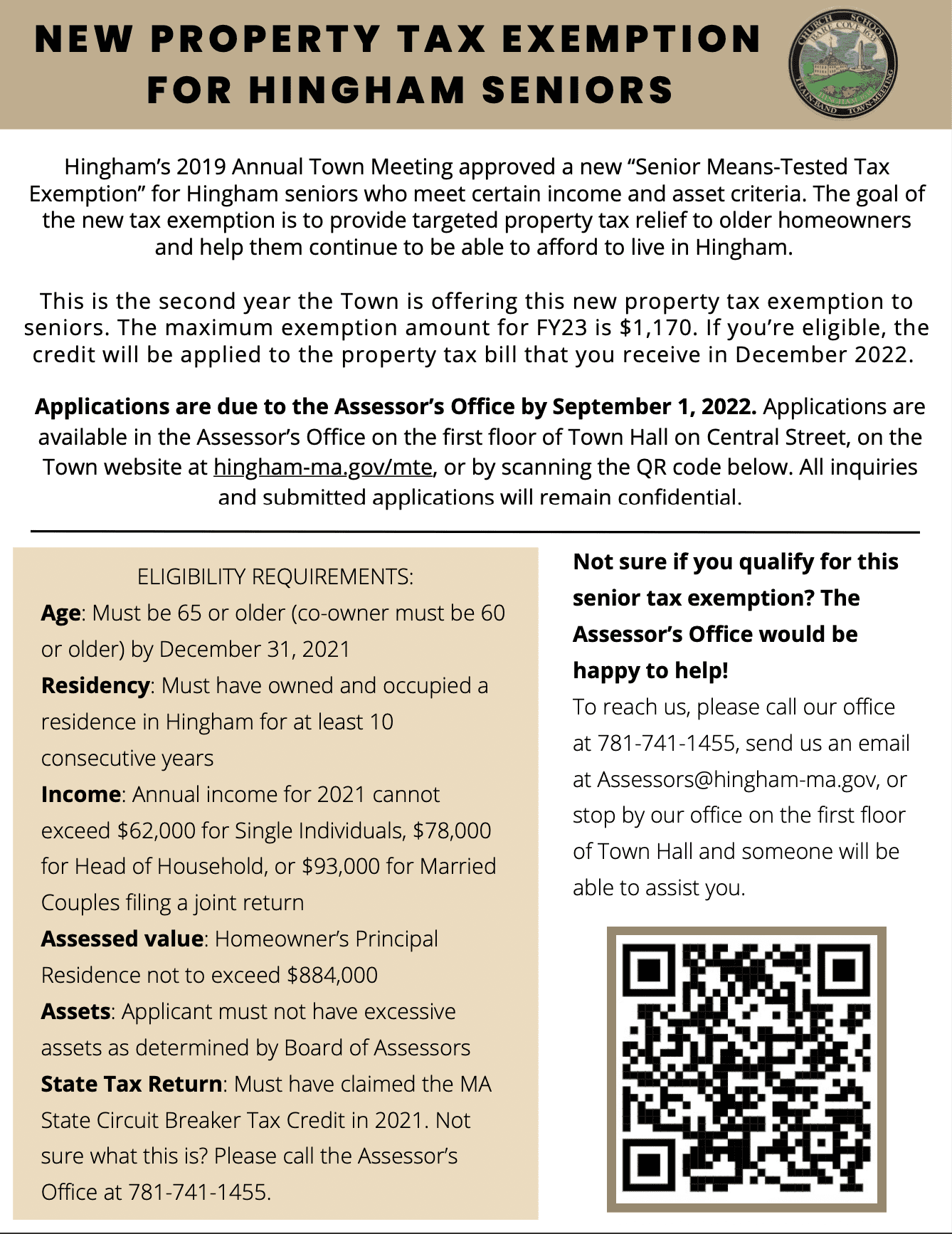

Voters at the 2019 Annual Town Meeting approved a new Senior Means-Tested Tax Exemption for Hingham seniors who meet certain income and asset criteria, with the goal of providing targeted property tax relief to older homeowners to help them continue to be able to afford to live in Hingham.

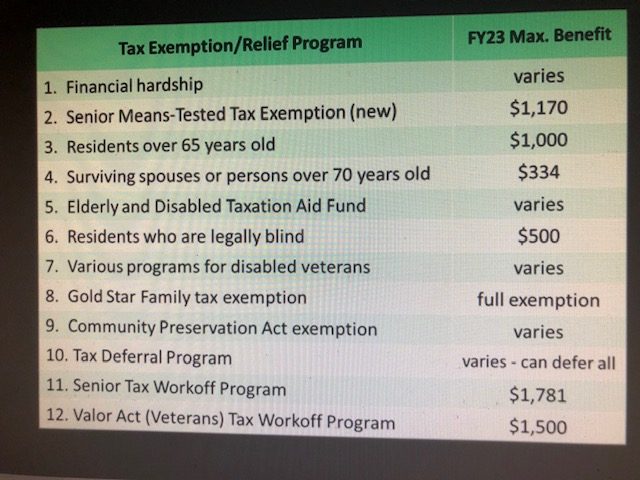

The maximum exemption amount for FY23 is $1,170. For those who are eligible, the credit will be applied to the property tax bill they receive in December 2022. (See related charts for complete tax relief information.)

"The Senior Means-Tested Tax Exemption is unique to Hingham and a handful of other Massachusetts communities," Asst. Town Administrator for Finance Michelle Monsegur told the Hingham Anchor. "We made a concerted effort to get the word out more widely this year, and we got 96 applicants compared to 24 last year (the first year), which is a 300 percent increase."

A similar outreach campaign will be implemented this winter to ensure residents are aware of the other tax exemptions and programs that are also available.

Citizens who meet the criteria for the various programs are encouraged to explore what they have to offer looking toward the funding that will be requested -- and potentially approved -- for a proposed new Foster School and public safety facility at the Nov. 1 Special Town Meeting in addition to an anticipated Fiscal 2024 $4.9 million operating override.

Voters will be asked to fund the remainder of the full project cost of $113.3 million for a new Foster School, which includes the Massachusetts School Building Authority-approved $24.6 million contribution and the previously authorized $1.1 million for a feasibility study and $3.1 million for design development and pre-construction documents.

Voters will also consider a warrant article asking for approval to fund a proposed new public safety facility at $46.7 million, with a projected borrowing of $48.3 million -- which includes the pre-construction costs authorized by Town Meeting in April 2022.

Both projects, if approved, would be funded by a debt exclusion -- which is a temporary funding measure involving a property tax increase -- while an override becomes part of the permanent tax base.

Other tax relief programs include exemptions related to financial hardship, a tax credit for residents over age 65, programs for disabled veterans, and an Elderly and Disabled Taxation Aid Fund -- among others -- for residents who qualify.

"Many of these programs would significantly reduce or eliminate altogether the estimated tax impact of the two building projects [for qualifying Hingham residents]," Monsegur said. "Our Assessing staff is very knowledgeable about these programs and can provide more details."